For over 25 years Cimarron has been a leading provider of integrated cad/cam solutions for tool makers and manufacturers of discrete parts scimitar ons integrated solution for die makers covers the entire die making process from quoting to design through engineering changes all the way to ANSI and EDM programming in this demonstration we will show you how scimitar on provides the die making expert with the ideal mix of automation and user control to help you design the strip for manufacturing this part the part we have chosen for this demonstration represents some demanding challenges faced by die maker we will begin by opening the die wizard you can import a part file from any major CAD system and in any format CIMMYT Ron provides one of the strongest translation packages in the market an intuitive wizard gives you the flexibility to create a strip of a single part to mirror parts or two totally different parts in this demo we will create a part and it's mirror we will now focus on forming the first part symma Kron offers powerful built-in finite element analysis tools to perform real-time thickness and safety zone analysis predicting potential failure areas in the model these tools are always accessible from within the system allowing for instant analysis of any modification made to the part at any point in time the part we use in our example requires a 3d carrier you can easily create a 2d or 3d carrier using symmetry enriched surfaces package symmetries intuitive working environment offers powerful wireframe surfacing and solid functionalities all readily available to complete any job to the highest standard you we will now copy the master in order to begin forming the necessary shapes for each station for purpose of speed and ease of use...

PDF editing your way

Complete or edit your dd2981 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form dd2981 for federal jobs directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 2981 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your dd form 2981 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

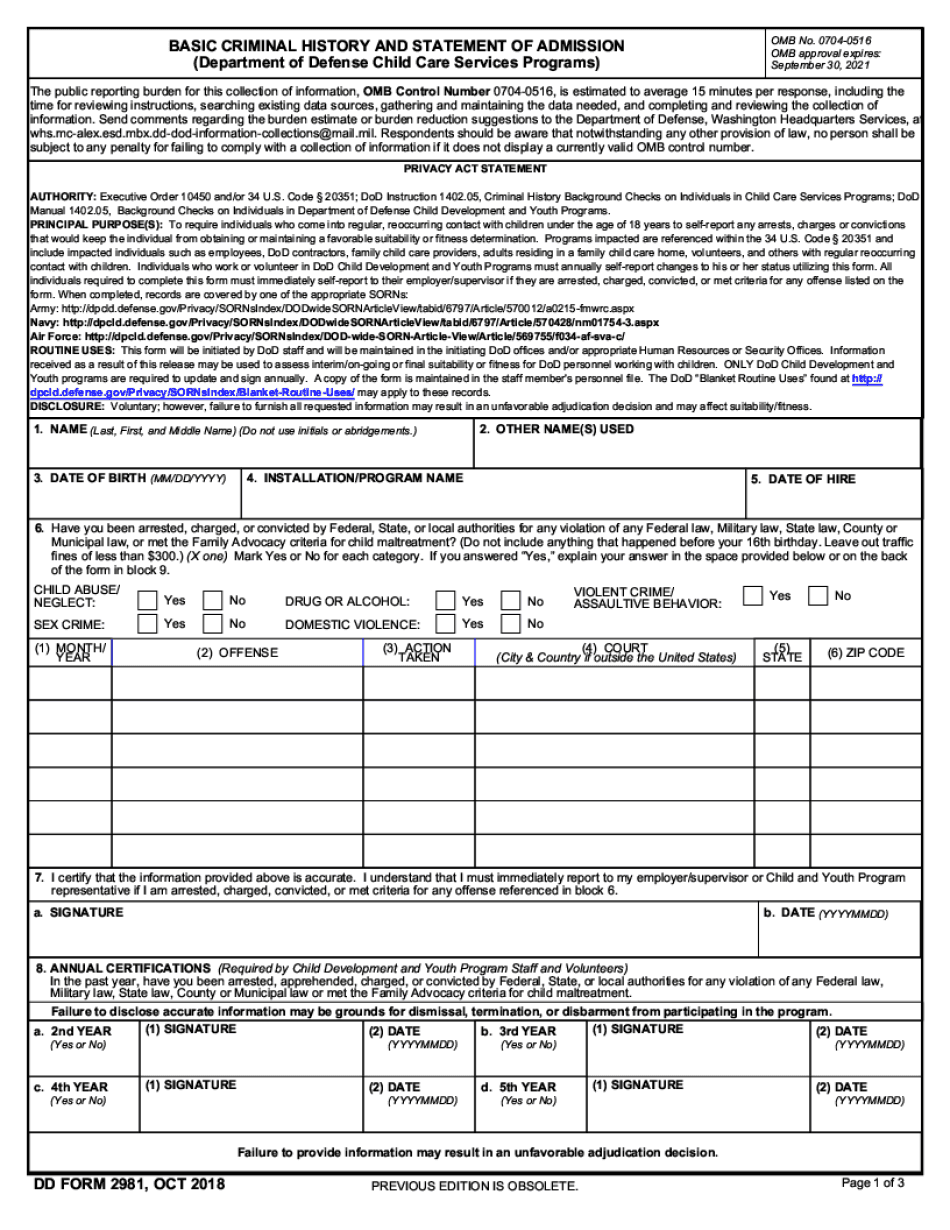

How to prepare Dd Form 2981

About Dd Form 2981

DD Form 2981, also known as the "Military Working Dog (MWD) Medical Record," is a document used by military dog handlers to record essential medical information about their working dogs. This form provides a comprehensive record of medical and health-related activities of the military working dog, including vaccinations, treatments, surgeries, diagnostics, and any other medical interventions. It serves as a primary reference for maintaining the health and well-being of the MWD throughout its career. The DD Form 2981 is typically required for all military working dogs, including those in the Army, Navy, Air Force, and Marine Corps. It is utilized by both active-duty military personnel and civilian dog handlers who work under the umbrella of the military. This form helps to ensure a systematic approach to monitoring and tracking the medical care of these highly trained canines.

Online technologies make it easier to arrange your document administration and strengthen the productiveness of your workflow. Follow the short guide to complete Dd Form 2981, stay clear of errors and furnish it in a timely way:

How to complete a Dd2981?

-

On the website containing the document, click Start Now and pass for the editor.

-

Use the clues to fill out the pertinent fields.

-

Include your individual details and contact details.

-

Make sure you enter right information and numbers in suitable fields.

-

Carefully examine the information of the blank so as grammar and spelling.

-

Refer to Help section if you have any issues or address our Support team.

-

Put an digital signature on the Dd Form 2981 Printable using the help of Sign Tool.

-

Once document is completed, click Done.

-

Distribute the ready via email or fax, print it out or download on your device.

PDF editor makes it possible for you to make changes to your Dd Form 2981 Fill Online from any internet linked device, customize it according to your requirements, sign it electronically and distribute in different means.

What people say about us

Complex document management, simplified

Video instructions and help with filling out and completing Dd Form 2981